- Planned Giving Legacy Society

- Ways to Give

- What to Give

- Life Stage Gift Planner™

- Compare Gift Options

- Blog

- Request a Calculation

- Glossary

- Bequest Language

- Contact Us

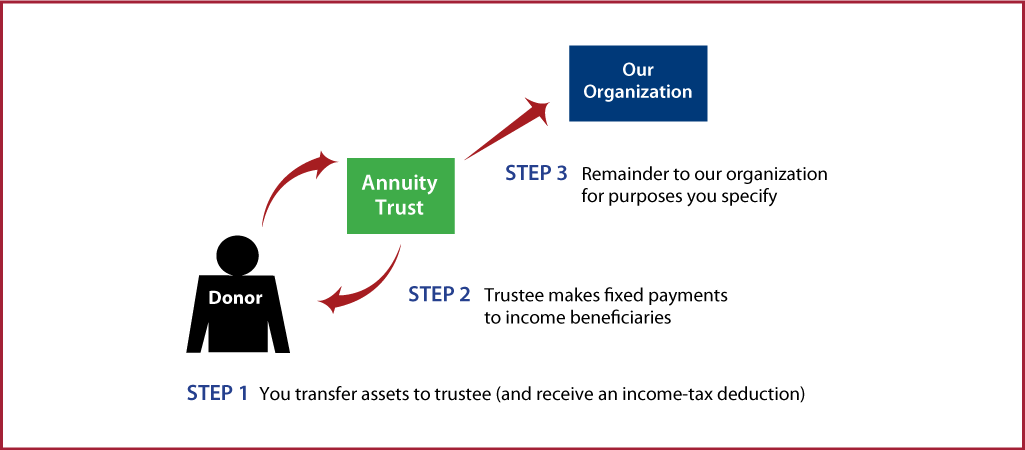

Charitable Remainder Annuity Trust

How It Works

- Create trust agreement stating terms of the trust; transfer cash or other property to trustee

- Trustee invests and manages trust assets and makes payments to income beneficiaries you designate

- Remainder to Darrow for purposes you specify

Benefits

- Payments to one or more beneficiaries that remain fixed for the life of the trust

- Federal income-tax deduction for the charitable remainder value of your interest

- No capital-gain tax when trust property is sold

- Trust remainder will provide generous support for Darrow

More Information

Request Calculation

Contact Us

Miranda Meyers

Associate Director of Advancement

Darrow School

110 Darrow Road

New Lebanon, NY 12125

E-mail: meyersm@darrowschool.org

518-704-2776

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer