- Planned Giving Legacy Society

- Ways to Give

- What to Give

- Life Stage Gift Planner™

- Compare Gift Options

- Blog

- Request a Calculation

- Glossary

- Bequest Language

- Contact Us

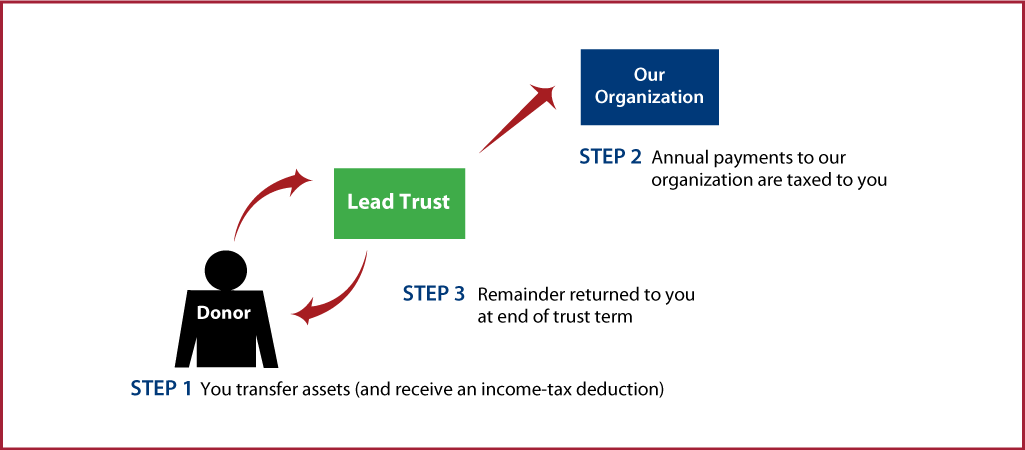

Grantor Lead Trust

How It Works

- Create trust agreement stating terms of the trust (usually for a term of years), transfer cash or other property to trustee, and receive an income-tax deduction

- Trustee invests and manages trust assets and makes annual payments to Darrow

- Remainder transferred back to you

Benefits

- Annual gift to Darrow

- Property returned to donor at end of trust term

- Professional management of assets during term of trust

- Charitable income-tax deduction, but you are taxed on trust's annual income

More Information

Request Calculation

Contact Us

Miranda Meyers

Associate Director of Advancement

Darrow School

110 Darrow Road

New Lebanon, NY 12125

E-mail: meyersm@darrowschool.org

518-704-2776

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer